API Integration

TIN Comply's API provides accurate, real-time validation to help businesses reduce administrative burdens and meet compliance requirements. By integrating this automated verification into your workflows, you can enhance data integrity, streamline vendor and employee onboarding, and strengthen your compliance efforts—all while minimizing manual effort and associated costs.

Simple REST API Using JSON

TIN Comply's API follows a RESTful architecture and utilizes JSON formatting for requests and responses.

- Send an HTTP POST request to the API endpoint.

- Include your API Key in the headers as the value of the

"X-API-Key"key. - Format your request body in JSON for seamless processing.

- All communication is encrypted over HTTPS to ensure data security.

REST Endpoints

TIN Comply offers 10 different API endpoints, each providing unique validation capabilities.

- Most users integrate with:

validate/irs-tin-name-matching– A dedicated endpoint for IRS TIN and name matching.

Orvalidate– A multi-functional endpoint that processes multiple validation types.

Each endpoint is designed to offer fast, reliable, and compliant validation services, enabling businesses to automate verification processes with ease.

List of API Endpoints

| Endpoint | Description |

|---|---|

validate |

Processes multiple validation types in one request. |

validate/irs-tin-name-matching |

Verifies IRS TIN and Name combinations. |

validate/company-name-lookup-by-ein |

Retrieves company names based on EINs. |

validate/company-ein-lookup-by-name |

Finds EINs using company names. |

validate/address-validation |

Validates and standardizes addresses. |

validate/fatca-giin |

Checks the validity of FATCA GIINs. |

validate/legal-entity-identifier |

Verifies Legal Entity Identifiers (LEI). |

validate/list-sanctions |

Screens entities against global sanctions lists. |

validate/company-details-lookup-by-name-address |

Retrieves company details using name and address. |

request-details |

Returns the details of a particular validation request. |

Setting Up a Simple IRS TIN Matching Request

Follow these steps to send a basic IRS TIN Matching request using the API.

Step 1: Generate an API Key

- Navigate to Admin -> API Key Management.

- Add a new API key to authenticate your requests.

Step 2: Create an HTTP POST Request

Include your API Key in the headers as "X-API-Key".

X-API-Key: "Ahf0omHcWphNKunRT44w5dfgdQAbHvnavp0z10"

Step 3: Set Request Parameters in JSON

Construct the request body using JSON syntax:

{

"tin": "123-12-1234",

"name": "JOHN SMITH"

}

Step 4: Send the Request

Send the request to the IRS TIN Matching API endpoint:

https://www.tincomply.com/api/v1/validate/irs-tin-name-matching

Step 5: Handle the JSON Response

The API returns a response in JSON format:

{

"id": "BG5CF5Z2q0SwIBmhZylJggxp",

"request": {

"tin": "XXXXX1234",

"name": "JOHN SMITH",

"requestDate": "2025-02-19T20:23:41Z",

"requestedServices": "irs-tin-name-matching"

},

"irsTinNameMatchingResult": {

"message": "TIN and Name combination does not match IRS records",

"result": 3,

"completed": true

}

}

Example Setup in Postman

Follow these steps to configure and test a request in Postman.

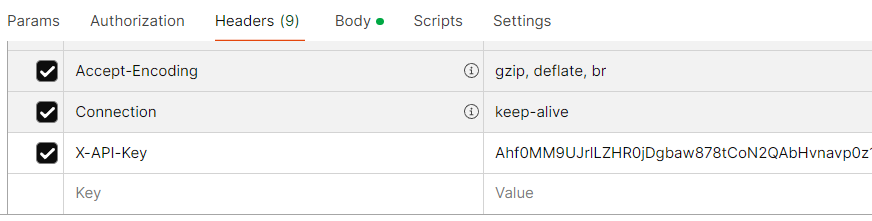

1. Headers Setup

Ensure your request includes the necessary headers, including the API Key.

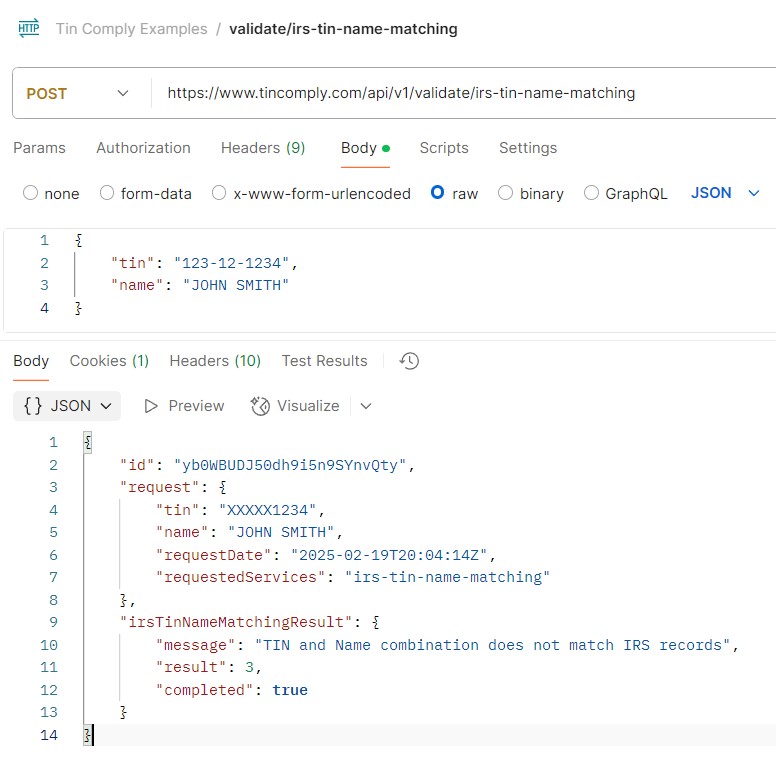

2. JSON Body Setup

Format the request body in JSON to include the required parameters.

By following this Postman setup, you can quickly test and integrate TIN Comply's API for validation requests.

Related

- API Integration

- API Endpoint: Address Validation

- API Endpoint: Company Details Lookup by Name Address

- API Endpoint: Company EIN Lookup by Name

- API Endpoint: Company Name Lookup by EIN

- API Endpoint: FATCA GIIN

- API Endpoint: IRS TIN Name Matching

- API Endpoint: Legal Entity Identifier

- API Endpoint: List Sanctions

- API Endpoint: Request Details

- API Endpoint: Validate