Validate Vendor Identity Before the Payment. Not After the Penalty.

Our portal. Your stack. Or fully managed.

However your team works.

Our portal. Your stack. Or fully managed.

However your team works.

Everything you need to succeed, all in one powerful platform

Instantly verify TINs and names against IRS records to reduce errors, avoid B-Notices, and stay tax compliant.

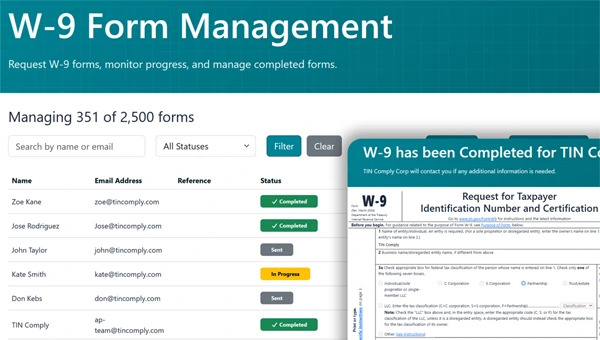

Use W-9 Management to send a secure link, collect signatures, and store completed W-9s.

Experience blazing-fast performance with our optimized infrastructure designed for speed and reliability.

Let our team handle vendor data remediation, IRS notice workflows, W-9 collection, and penalty support end-to-end.

Screen individuals and businesses against OFAC, AML, and global sanctions lists to minimize compliance risk.

Upload and process large files at once for fast, high-volume TIN and EIN verification.

Access full validation histories so you can easily review results, support audits, and demonstrate compliance to regulators.

Quickly discover the correct Employer Identification Number (EIN) for a business name-and vice versa-so you always engage with accurate entity information.

Stay compliant. Avoid unnecessary IRS penalties with Tin Comply.

Start Your Free TrialTIN Comply provides automated tools to resolve IRS TIN/Name mismatches by combining real-time validation, EIN discovery, and secure W-9 collection.

Run real-time IRS TIN/Name validation to confirm taxpayer information before payment or 1099 filing.

Instantly identify invalid TINs, name mismatches, and non-issued results with clear status indicators and audit history.

Search for missing or incorrect EINs to help correct records without manual research or vendor outreach.

Send W-9 requests with electronic signature, status tracking, and secure storage of completed forms.

When IRS matching fails, send a W-9 request instantly and track completion in one dashboard.

Let our team handle vendor data remediation, IRS notice workflows, W-9 collection, and penalty support end-to-end — delivering audit-ready documentation, cleaner records, and fewer compliance surprises.

Upload your vendor list and we manage secure W-9 collection, reminder workflows, validation, and audit logging — with optional physical mailing for non-responsive payees.

Clean, standardize, and reconcile vendor data to eliminate duplicates, normalize entity names, correct addresses, and prepare an audit-ready master file for 1099 reporting and compliance.

End-to-end CP2100 remediation including mismatch analysis, First and Second B-Notice workflows, W-9 outreach, and defensible documentation to reduce repeat notice cycles.

Review IRS penalty assessments, assemble supporting documentation, provide remediation history, and assist with abatement response packages to strengthen your defense.

Trusted by Finance & Compliance Teams

We had over 8,000 vendors and were drowning in TIN mismatches every January. TIN Comply helped us clean the file before filing season. Our CP2100 volume dropped dramatically and the audit trail made our year-end review a non-event.

We received a 972CG penalty notice with a very short window to respond. TIN Comply's managed services team reconstructed our correction history, organized the evidence pack, and helped us build a reasonable-cause response. The process was clear and fast when it needed to be.

We onboard hundreds of contractors a month. Embedding TIN Comply's API into our onboarding flow meant mismatches get caught before anyone gets paid and not after we've filed 1099s. The documentation was clean and the integration was genuinely fast.

Customer Outcomes

Gig Economy / Payroll

The Challenge

With thousands of new contractors onboarded monthly, the team discovered TIN errors only at 1099 time requiring expensive emergency remediation every January.

TIN validation now runs at onboarding, not at filing

97% reduction in year-end mismatch corrections

Sanctions screening added with no additional integration work

Accounts Payable

The Challenge

After an ERP migration, the AP team discovered thousands of vendor records with inconsistent names, missing EINs, and no W-9 documentation. Filing season was 90 days away.

5,200 vendor records cleaned and validated in 3 weeks

94% W-9 collection rate via managed outreach

Zero CP2100 notices the following filing season

Tax & Compliance

The Challenge

The compliance team needed to validate vendor TINs before ACH payments were released without slowing down the payment cycle or adding manual review steps.

API integrated into payment workflow in 2 days

Mismatched payees automatically routed to exception queue

Audit trail satisfies internal controls review quarterly

Join thousands of companies already growing with Tin Comply

Start Your Free Trial